Free Printable Checkbook Register: Are you tired of struggling to keep track of your personal finances? Look no further! In this article, we will guide you on how to create and use a free printable checkbook register. Say goodbye to financial chaos and hello to financial organization!

Creating a Free Printable Checkbook Register: We will provide you with step-by-step instructions and tips on formatting and organizing your register. Get ready to take control of your money in a simple and efficient way!

Introduction to Checkbook Register

A checkbook register is a tool used to keep track of personal finances. It is a record-keeping system that allows individuals to monitor their income, expenses, and account balances. By recording every transaction, whether it be writing a check, making a deposit, or withdrawing money, individuals can have a clear picture of their financial situation.Keeping

track of personal finances is crucial for several reasons. Firstly, it helps individuals to have a better understanding of their spending habits and patterns. By regularly recording their expenses, individuals can identify areas where they may be overspending and make necessary adjustments to their budget.Secondly,

If you’re looking for coloring pages of Paw Patrol, you’re in luck! We have a great collection of coloring pages Paw Patrol printable that you can easily print and enjoy. Whether your child is a fan of Chase, Marshall, Skye, or any other member of the Paw Patrol team, these coloring pages are perfect for them to bring their favorite characters to life.

Simply click on the link to access the printable coloring pages and let the creativity begin!

maintaining a checkbook register allows individuals to keep track of their account balances. This is especially important to avoid overdrawing from the account, which can result in costly fees and penalties. By knowing their current balance, individuals can make informed decisions about their spending and avoid financial difficulties.Using

a checkbook register offers numerous benefits. It provides individuals with a clear and organized record of their financial transactions, making it easier to reconcile their bank statements and identify any discrepancies. It also serves as a reference tool, allowing individuals to track their financial progress over time and set financial goals.

The Importance of Recording Every Transaction

Recording every transaction in the checkbook register is crucial for accurate financial management. By diligently recording all income and expenses, individuals can maintain an up-to-date and accurate record of their finances. This ensures that they have an accurate picture of their account balances and can make informed decisions about their spending.To

ensure the accuracy of the checkbook register, it is important to include all transactions, regardless of the amount. Even small purchases or deposits should be recorded to ensure that the register reflects the true financial situation.

Benefits of Using a Checkbook Register

- Track Spending: Using a checkbook register allows individuals to track their spending habits and identify areas where they may be overspending.

- Manage Budget: By regularly recording expenses, individuals can create a budget and make necessary adjustments to ensure they are living within their means.

- Avoid Overdrafts: Maintaining an accurate checkbook register helps individuals avoid overdrawing from their accounts, preventing costly fees and penalties.

- Reconcile Bank Statements: A checkbook register serves as a reference tool when reconciling bank statements, making it easier to identify any discrepancies.

- Set Financial Goals: By tracking their financial progress over time, individuals can set realistic financial goals and work towards achieving them.

Remember to record every transaction in your checkbook register to ensure accurate financial management and to have a clear understanding of your financial situation.

Creating a Free Printable Checkbook Register

Creating a free printable checkbook register can be a useful tool in managing your finances. It allows you to keep track of your income, expenses, and account balance in a clear and organized manner. Here are some steps to help you create your own checkbook register:

Step 1: Determine the Format

First, decide on the format you want for your checkbook register. You can choose to create a digital version using spreadsheet software or opt for a printable version that you can fill in by hand. Both options have their advantages, so choose the one that suits your preference and needs.

Step 2: Choose a Software or Online Tool

If you prefer a digital checkbook register, there are several software options you can use. Popular choices include Microsoft Excel, Google Sheets, and Quicken. These programs offer pre-designed templates that you can customize to fit your specific requirements. Additionally, online tools such as Mint and Personal Capital provide budgeting and expense tracking features that include checkbook registers.

Step 3: Design and Organize the Register, Free printable checkbook register

Once you have chosen your software or online tool, it’s time to design and organize your checkbook register. Consider the following tips:

Start with the necessary columns

Date, Description, Income, Expense, and Balance. You may also include additional columns for categorizing your expenses or any other information you find relevant.

Format the cells

Adjust the width of the columns to accommodate the information you will be entering. You can also use formatting options to highlight specific cells or apply formulas for automatic calculations.

Add formulas

If you are using spreadsheet software, take advantage of the formula functions to automatically calculate the balance based on the income and expense entries.

Consider color-coding

Assign different colors to income and expense entries to make it easier to distinguish between the two.

Include a running balance

Make sure to include a running balance column that updates automatically as you enter new transactions.

Step 4: Print or Save the Register

If you have opted for a printable checkbook register, make sure to save a copy of the template on your computer for future use. You can print multiple copies to have a physical register for each month or keep a digital copy to update and print as needed.By

following these steps, you can create a free printable checkbook register that suits your needs and helps you stay on top of your finances. Whether you choose a digital or printable version, having a checkbook register can provide you with a clear overview of your financial transactions and assist you in making informed financial decisions.

The Essential Elements of a Checkbook Register

A checkbook register is an important tool for managing personal finances. It helps individuals keep track of their transactions, monitor their account balance, and reconcile their bank statements. To effectively use a checkbook register, it is essential to understand its necessary elements and their purpose.

1. Date

The date column in a checkbook register is used to record the date of each transaction. It allows users to track when a transaction occurred and helps in identifying any discrepancies or errors in the future.

2. Transaction Description

The transaction description column is used to provide a brief description or details of each transaction. It enables users to remember the purpose or nature of the transaction, making it easier to categorize and analyze expenses later on.

3. Check Number

If a transaction involves writing a check, the check number column is used to record the number of the check. This helps users in keeping a record of the checks they have written and enables them to easily match the transactions with their bank statements.

4. Debit

The debit column is used to record the amount of money that is being deducted or withdrawn from the account. It includes expenses such as payments made, withdrawals, or any other outflows of funds.

5. Credit

The credit column is used to record the amount of money that is being added or deposited into the account. It includes income received, deposits made, or any other inflows of funds.

6. Balance

The balance column is used to keep a running balance of the account after each transaction. It helps users in monitoring their account balance and ensures that they have an accurate record of their available funds.Having these essential elements ensures that a checkbook register provides a comprehensive and organized overview of an individual’s financial transactions.

However, personalization can be done by adding additional columns or features based on individual preferences and needs. Some optional columns that can be included are:

7. Category

The category column allows users to categorize their expenses or income, making it easier to analyze spending patterns and identify areas where adjustments can be made.

8. Memo

The memo column can be used to provide additional details or notes related to a particular transaction. It can be helpful for future reference or for clarifying any uncertainties.

9. Running Total

The running total column displays the cumulative total of the transactions as they are recorded. It provides a quick reference for the account balance without having to calculate it manually.By customizing the checkbook register with additional columns or features, individuals can tailor it to their specific financial management needs and preferences.

It allows for a more detailed and personalized tracking of transactions, providing a clearer picture of their financial situation.

Looking for a fun activity to do with your family? Why not try coloring together? Our website offers a wide range of family coloring pages printable that everyone can enjoy. From simple designs for younger kids to more intricate ones for adults, there’s something for everyone.

Coloring is not only a great way to bond with your family, but it also helps improve focus and creativity. So grab your coloring pencils and start creating beautiful masterpieces together!

Tracking Income and Expenses

Recording Income in the Checkbook Register:To record income in the checkbook register, follow these steps:

- Write the date of the income transaction in the date column of the register.

- In the description column, briefly note the source of the income (e.g., salary, freelance payment, rental income).

- Enter the amount of income in the deposit or credit column.

- Calculate the new balance by adding the income amount to the previous balance.

- Repeat these steps for each income transaction.

Different Methods for Categorizing and Tracking Expenses:There are several methods you can use to categorize and track expenses in your checkbook register:

- Categories:Create specific categories for different types of expenses, such as groceries, utilities, entertainment, and transportation. Assign each expense to the appropriate category.

- Subcategories:If you want to further break down your expenses, you can create subcategories within each main category. For example, under the groceries category, you could have subcategories for fruits, vegetables, and snacks.

- Tags:Another method is to use tags to label expenses. You can assign multiple tags to each expense to indicate different characteristics or purposes.

- Color Coding:If you prefer a visual method, you can assign different colors to different expense categories or subcategories. This makes it easier to identify and track expenses at a glance.

Tips on Reconciling the Register with Bank Statements:To ensure the accuracy of your checkbook register, it’s important to reconcile it with your bank statements regularly. Here are some tips to help you with the reconciliation process:

- Compare the transactions in your checkbook register with the transactions listed on your bank statement.

- Check for any discrepancies, such as missing or duplicated transactions.

- Make note of any outstanding checks or deposits that have not yet cleared.

- Adjust your checkbook register to reflect any discrepancies or outstanding transactions.

- Calculate the new balance in your checkbook register by adding or subtracting any adjustments made during the reconciliation process.

- Keep track of the date and amount of any adjustments made to your checkbook register.

Remember, regularly reconciling your checkbook register with your bank statements helps you catch any errors or fraudulent activity and ensures that your financial records are accurate.

Benefits of Using a Printable Checkbook Register: Free Printable Checkbook Register

Using a printable checkbook register offers several advantages over digital alternatives. Not only does it provide a tangible record of your financial transactions, but it also helps with budgeting and financial planning. Additionally, a physical register can serve as a visual reminder to stay on top of your finances, promoting better financial habits.

Advantages of Using a Printable Checkbook Register

Maintaining a printed checkbook register allows you to have a clear and organized overview of your financial transactions. Unlike digital alternatives, a physical register provides a visual representation of your income and expenses, making it easier to track and manage your finances effectively.

- Accuracy: A printable checkbook register allows you to record your transactions manually, reducing the risk of errors or discrepancies that may occur with digital systems.

- Budgeting Tool: By regularly updating your checkbook register, you can monitor your spending habits and identify areas where you can cut back or save. This promotes better budgeting and helps you stay on track with your financial goals.

- Financial Awareness: Having a physical register serves as a visual reminder of your financial responsibilities. It encourages you to be more conscious of your spending and helps you make informed decisions about where your money goes.

- Emergency Preparedness: In the event of a technological failure or loss of digital records, a printed checkbook register ensures you have a backup copy of your financial transactions.

How a Physical Register Supports Budgeting and Financial Planning

A printed checkbook register plays a crucial role in budgeting and financial planning by providing a comprehensive view of your income and expenses. It allows you to:

- Track Spending: With a physical register, you can easily record and categorize your expenses, giving you a clear picture of where your money is going. This information is invaluable for creating a realistic budget and identifying areas for improvement.

- Monitor Savings: By regularly updating your register, you can track your savings progress and ensure you are setting aside enough money for your financial goals.

- Identify Financial Patterns: Analyzing your checkbook register can help you identify patterns in your spending and highlight areas where you may be overspending or making unnecessary purchases.

The Visual Reminder of a Printed Register

Having a physical register acts as a constant visual reminder to stay on top of your finances. It serves as a tangible representation of your financial health and encourages you to stay accountable to your financial goals. By regularly updating and reviewing your checkbook register, you can make more informed decisions about your spending and ensure your financial well-being.Remember,

using a printable checkbook register is a simple yet effective way to gain control over your finances, promote better budgeting habits, and achieve your financial goals.

Tips for Effective Use of a Checkbook Register

To maintain accurate and up-to-date records, it is crucial to follow these tips for effective use of a checkbook register. By implementing these strategies, you can stay organized and avoid common mistakes, while also being able to review and analyze the information in your register effectively.

Maintaining Accurate and Up-to-Date Records

- Record Every Transaction: Make it a habit to record every incoming and outgoing transaction in your checkbook register. This includes writing down checks you write, deposits you make, and any other transactions such as ATM withdrawals or online payments.

- Date and Description: Ensure that each entry in the checkbook register includes the date and a clear description of the transaction. This will help you easily identify and understand each transaction when reviewing your records.

- Balance Regularly: Regularly balance your checkbook register with your bank statement to ensure that all transactions are accurately recorded. This will help you spot any discrepancies or errors that need to be addressed.

- Keep Supporting Documents: Organize and keep supporting documents such as receipts, bank statements, and canceled checks. These documents can serve as evidence and help verify the accuracy of your checkbook register.

Staying Organized and Avoiding Common Mistakes

- Use Separate Columns: Create separate columns in your checkbook register for deposits, withdrawals, and current balance. This will help you easily track and calculate your account balance.

- Avoid Overdrawing: Regularly monitor your account balance to avoid overdrawing. Be mindful of any outstanding checks or pending transactions that haven’t cleared yet.

- Avoid Mistakes: Double-check your entries for accuracy before finalizing them. Mistakes in recording transactions can lead to discrepancies and confusion in your records.

- Review Regularly: Set aside time each month to review your checkbook register and ensure that all transactions are accurately recorded. This will help you identify any errors or fraudulent activities.

Reviewing and Analyzing the Information

- Identify Spending Patterns: Reviewing your checkbook register can help you identify your spending patterns and understand where your money is going. This awareness can help you make informed decisions and prioritize your expenses.

- Budgeting and Planning: Analyzing your checkbook register can assist you in creating an effective budget and financial plan. By understanding your income and expenses, you can allocate funds wisely and work towards your financial goals.

- Identify Errors or Discrepancies: Regularly reviewing your checkbook register can help you spot any errors or discrepancies, such as duplicate transactions or unauthorized charges. Promptly addressing these issues can prevent further complications.

Alternatives to Printable Checkbook Registers

Printable checkbook registers are not the only option for managing your finances. In this digital age, there are several alternatives available that offer convenience and efficiency. Let’s explore some of these digital options and compare their pros and cons.

Mobile Apps

Mobile apps have become increasingly popular for managing personal finances. They allow you to track your income and expenses on the go, right from your smartphone or tablet. Some popular mobile apps for checkbook tracking include Mint, PocketGuard, and Quicken.

Here are the pros and cons of using mobile apps:

- Pros:

- Convenient and accessible anytime, anywhere

- Automatic syncing with your bank accounts

- Real-time updates and notifications

- Advanced budgeting and expense categorization features

- Cons:

- Requires internet connection

- Potential security risks if not using a trusted app

- May have limited features in free versions

- Reliance on technology that may have occasional glitches

Online Tools

In addition to mobile apps, there are online tools available for managing your checkbook digitally. These tools can be accessed through web browsers on your computer or mobile devices. Some popular online checkbook tools include YNAB (You Need a Budget), Personal Capital, and Clearcheckbook.

Here are the pros and cons of using online tools:

- Pros:

- Accessible from any device with internet access

- Can be synchronized with multiple bank accounts

- Advanced reporting and analytics features

- Ability to collaborate and share with others

- Cons:

- Dependent on internet connectivity

- Potential security risks if using unsecured networks

- May have a learning curve to understand all features

- Some tools require a subscription or membership fee

Recommendations

For individuals who prefer digital methods over printouts, mobile apps and online tools can offer a more streamlined and efficient way to manage their checkbook. Here are some recommendations for choosing the right digital method:

- Consider your needs and preferences: Think about the features and functionalities that are most important to you.

- Read reviews and do research: Look for user reviews and compare different apps or tools to find the one that suits you best.

- Ensure security measures: Make sure the app or tool you choose has robust security measures in place to protect your financial data.

- Try before committing: Many apps and tools offer free trials or basic versions. Take advantage of these to test out the interface and features before making a decision.

- Keep backups: Whether you choose a mobile app or an online tool, it’s important to regularly backup your financial data to prevent any loss.

Using digital alternatives to printable checkbook registers can simplify the process of tracking your income and expenses. Whether you opt for a mobile app or an online tool, the key is to choose a method that fits your lifestyle and financial management needs.

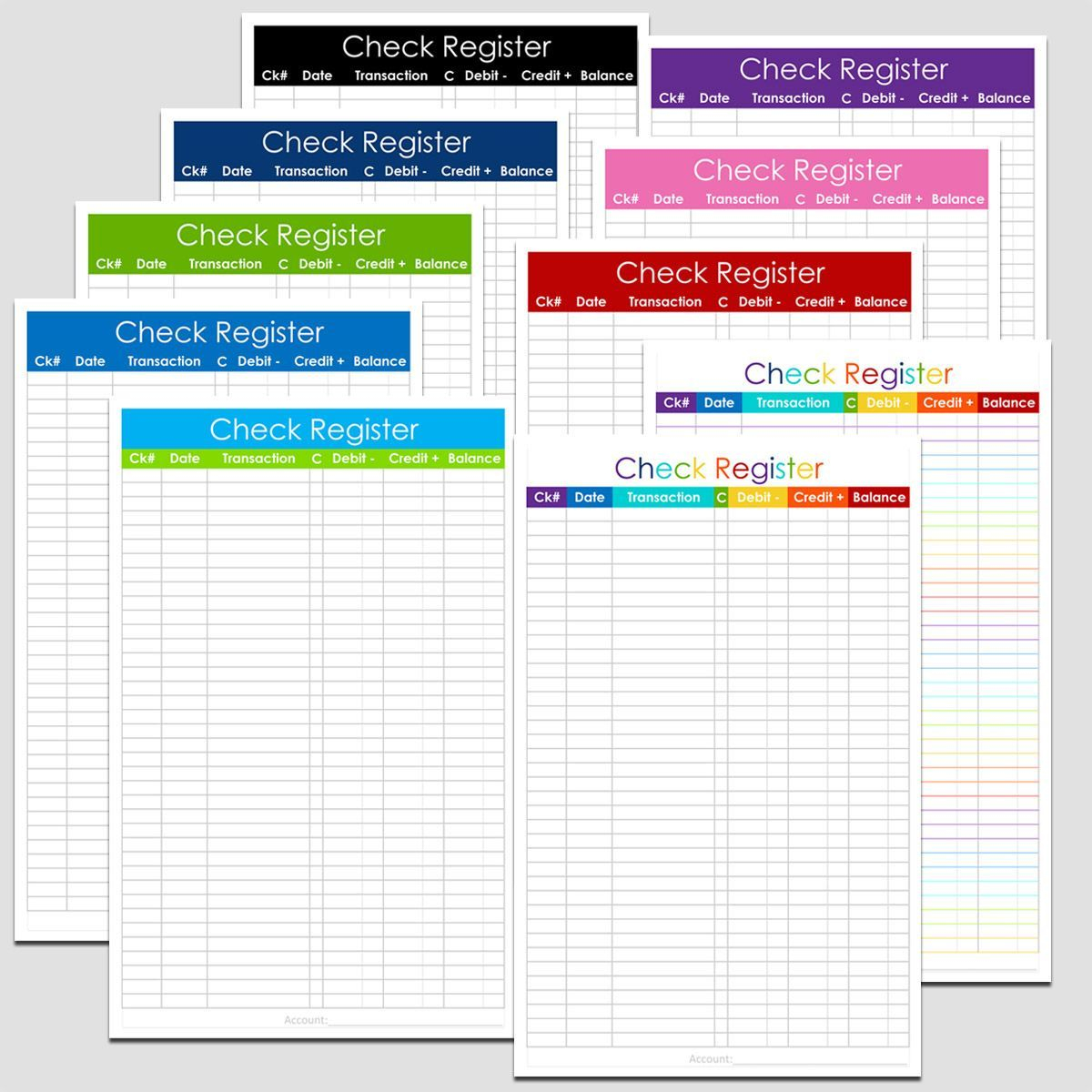

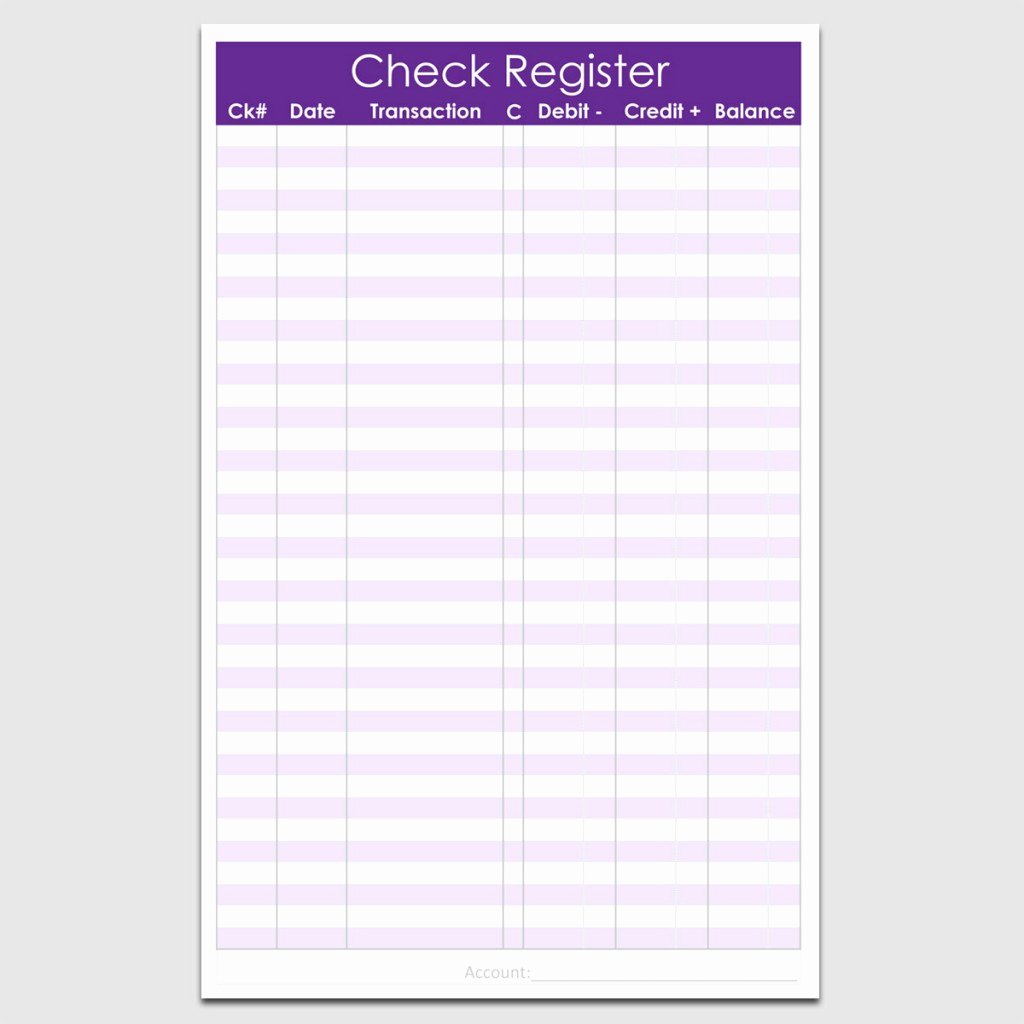

Printable Checkbook Register Templates

When it comes to managing your finances, using a checkbook register can be a helpful tool. It allows you to keep track of your income and expenses, ensuring that you have a clear picture of your financial standing. If you prefer a printable checkbook register, there are several websites and resources where you can find free templates to suit your needs.

Websites for Free Printable Checkbook Register Templates

Here are some websites where you can find a variety of free printable checkbook register templates:

- Template.net

- Vertex42

- Spreadsheet123

- PrintableCashReceipts.com

- Microsoft Office Templates

Variety of Templates Available

These websites offer a wide range of checkbook register templates with different designs and layouts. You can choose from simple and minimalist designs to more elaborate and colorful templates. Some templates may include additional features such as expense categories or space for notes, allowing you to customize your checkbook register according to your preferences.

Tips for Customizing and Using Templates Effectively

Here are some tips to help you customize and use printable checkbook register templates effectively:

- Choose a template that suits your needs and personal style. Consider factors such as the number of transactions you make, the level of detail you want to track, and your preferred layout.

- Print multiple copies of the template so you have a backup in case you run out of space or make any mistakes.

- Label the columns in your checkbook register clearly to ensure you can easily record and categorize your transactions.

- Regularly update your checkbook register by entering your income and expenses as they occur. This will help you maintain an accurate and up-to-date financial record.

- Review your checkbook register regularly to identify any discrepancies or errors. This will allow you to catch any mistakes and reconcile your records with your bank statements.